Getting cashback with a purchase increases your debt.

The control number consists of the following. Each control number is associated with a set of debits and credits, whose total must be equal to zero. There is one control number for each journal item created. If the date of is entered into the date box (note: need to then hit Enter or Tab to have this affect the control number), the control number will now start with 2008.12. Example: If the current system (computer or server) date is set to April 29, 2009, the control number will start with 2009.4. The Control Number will change if a date outside of the current month is entered into the Date field. The Control Number defaults to the system (computer or server) date. Juris will allow an unfinished item or items to be saved, to be completed at a later date, but Juris will not allow the batch to be posted until the balance of the batch is equal to zero (total Debits = total Credits). Note: Each Journal item allows multiple rows, or multiple debits and credits to be entered, but the Debits must equal the Credits. When the journal entry is complete, click Save.Enter the Reference description (may be up to 60 alphanumeric characters).Enter a Document number (may be up to 60 alphanumeric characters).Enter the amount in either the debit or credit column, as appropriate.The Description field will automatically populate with the account description when the account is selected.Enter an account number or select an account from the lookup by double-clicking in the Account field.Using Reversing Entry will post 2 journal entries: one on the date you used in the journal entry and a reversing entry posted on the first date of the following month. An easier solution is to post a journal entry and mark it as a Reversing Entry. To clear the bank reconciliation, you can do a reconciling entry for the month, and do another next month to reverse the entry. This will cause a $10 unreconciled difference on both sides. The bank admitted error on the deposit and will deposit the remaining $10 your account the following month. You deposited $100 to the bank, but they only cleared $90. This information is used in Cash Flow Statement reporting, and simply flags that entry as a correction. The " Correcting Entry" option is used if the Journal Entry corrects some previously entered entry that was incorrect.If the " Reversing Entry" option is selected, a reversing Journal Entry with the Starting Date of the Next Accounting Period will be generated in addition to the new Journal Entry created based on the date speicified.The "Reversing Entry" and "Correcting Entry" boxes may be checked, if desired.

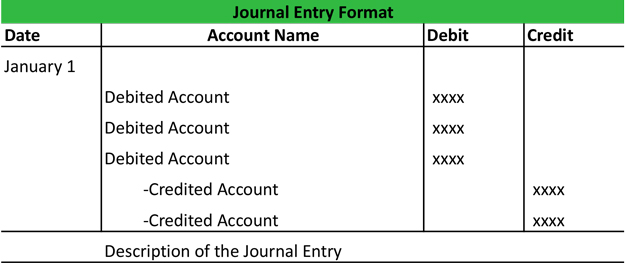

#DEBIT CREDIT JOURNAL ENTRIES MANUAL#

Manual batches should also be given a source that is descriptive.

Batches created through Juris® use the source to define where the entries were generated (i.e. The source is used to describe the area where the batch was originated from.

The Journal Entries function allows the firm to affect G/L Account activity directly by allowing the posting of Debits/Credits amounts to specified G/L Accounts.

0 kommentar(er)

0 kommentar(er)